Alright, let's make this practical.

Yesterday I showed you the supplement brand that fixed profit without touching price.

Today I want to give you the diagnostic so you can figure out if you're dealing with the same issue.

Because here's the thing … under-yielding doesn't announce itself.

It doesn't show up as a crisis. It shows up as a feeling.

The feeling that you're working hard but not getting ahead.

The feeling that one bad week would hurt more than it should.

The feeling that scaling feels risky even though the fundamentals seem solid.

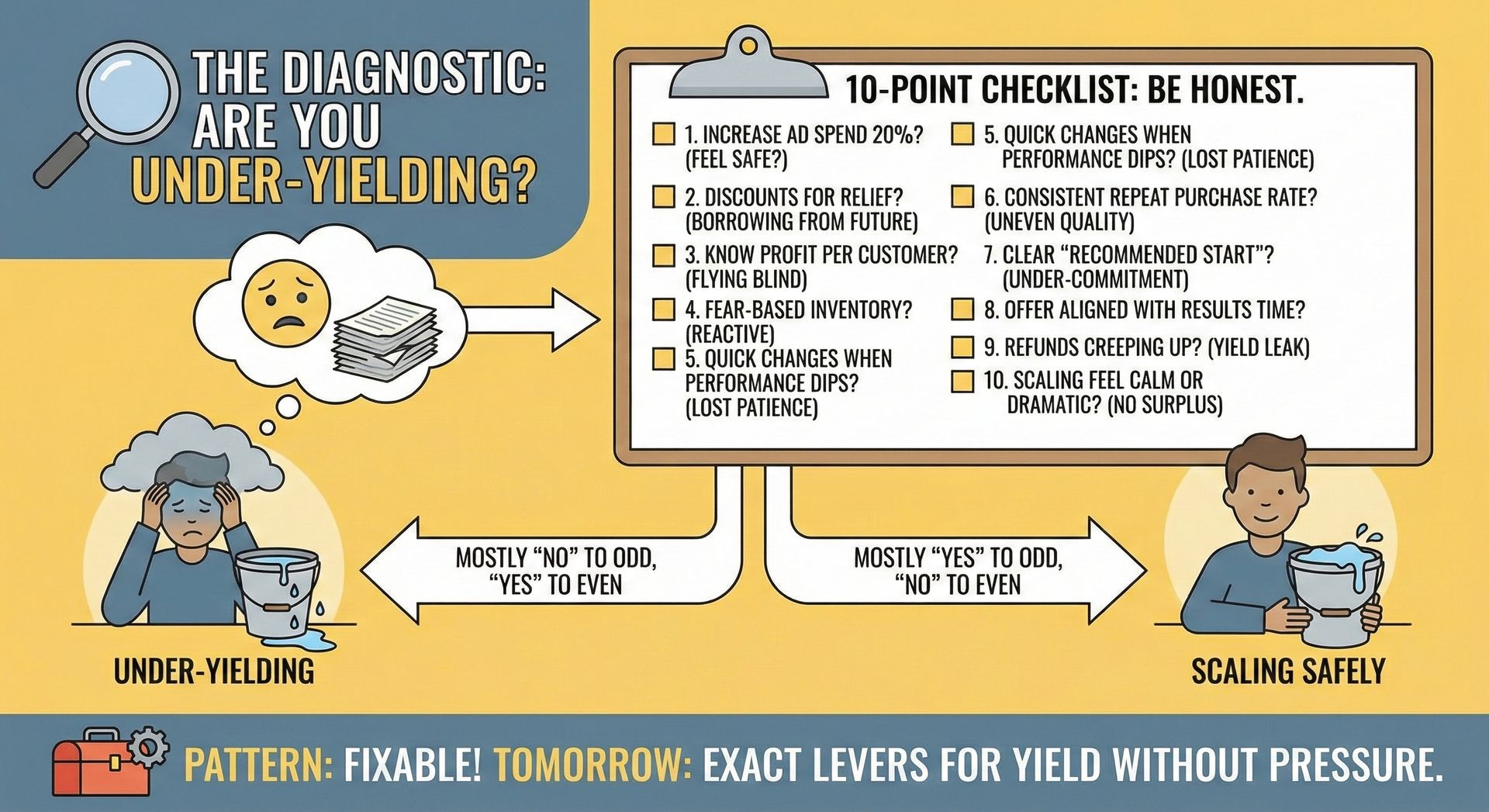

So here are the questions I ask on client calls. Answer these honestly …

1. Can you increase ad spend by 20% this week without your stomach dropping?

If no … You don't have enough margin to feel safe scaling.

2. Are you using discounts because they're part of a strategy... or because you need relief?

If relief … You're borrowing from the future.

3. Do you know your profit per new customer (not just ROAS)?

If no … You're flying blind on the metric that actually matters.

4. Are you making inventory buys based on demand signals... or based on fear of stockouts?

If fear … Thin margin is making you reactive.

5. When performance dips, do you typically change something within 48 hours?

If yes … You've lost patience, which means you've lost margin.

6. Is your repeat purchase rate consistent across cohorts, or does it bounce around?

If bouncy … Customer quality is uneven, which usually traces back to acquisition pressure or offer misalignment.

7. Do customers have a clear "recommended start," or do they face multiple options?

If multiple … You're creating hedging and under-commitment.

8. Is your offer structure aligned with how long results actually take?

If no … Customers are under-buying, evaluating too early, and churning before outcomes happen.

9. Are refunds/returns creeping up (even slowly)?

If yes … Expectations aren't aligned, which is a yield leak.

10. Does scaling feel calm or dramatic?

If dramatic … the system isn't creating enough surplus to handle pressure.

Here's the pattern …

If you answered "yes" to questions 1, 3, 6, 7, 8 and "no" to the others—you're probably fine.

If you answered the opposite way on most of these? You're under-yielding.

The good news … this is fixable.

The better news … the fix doesn't require you to become a different person or rebuild your entire business.

Tomorrow I'm going to walk you through the exact levers you can pull to increase yield without adding pressure.

Because here's what most people get wrong: They think profit optimization means "extract more."

It doesn't.

It means capture value from aligned interactions without degrading trust, results, or retention.

See you tomorrow,

Jeremiah

P.S. If you're reading this and realizing "Oh crap, that's me" … don't panic. Seeing the pattern clearly is 80% of the fix.

100% Typo Guarantee … This message was hand-crafted by a human being … me. While I use AI heavily for my research and the work I do, I respect you too much to automate my email content creation.

There was no review queue, no editorial process, no post-facto revisions. I just wrote it and sent it … therefore, I can pretty much guarantee some sort of typo or grammatical error that would make all my past english teachers cringe.

Anonymous Data Disclaimer … Most of my clients prefer that I not share the inner workings of their businesses or the exact details of the marketing strategies we develop. In order to be able to share my own proprietary intellectual property without violating the sensitive nature of my relationship with them, I often anonymize what I share with you. This may include changing the specifics of their industry, what actually happened, or what we developed together. When I make these changes, I work to preserve the success principle I want to convey to you while obscuring sensitive data. This is necessary.